Michael Hudson responds to questions after Against Economics lecture

In January 2025, the DGI held a meeting with Michael Hudson about David Graeber’s essay Against Economics. After the event, we received many questions and asked Michael to address some of them. Join our next meeting with Michael Hudson on April 4th.

“The mainstream left, which is barely left at all at this point in traditional terms … has really embraced a combination of market and bureaucracy, an equal synthesis of the worst aspects of capitalism and the worst aspects of bureaucracy.

Nobody really likes it. It’s this kind of constant compromise in principles, which creates this [policy] mish-mash that basically nobody would come up with or promote as a program in itself.”

– David GraeberMH: the false-left Labor and Social Democratic parties have replaced the concept of wage-earners with a post-modern identity politics of every identity EXCEPT wage-earners: race and ethnic identity, LBGTQ and so forth. The idea is to distract attention from the actual economic dynamics that are impoverishing labor and, in the process, have been de-industrializing the Western economies since the 1980s.

The ”left” emerged from classical political economy and its value theory. The key to its approach was to define economie rent (R) as the excess of market price (P) over intrinsic cost-value (V). Such rent was unearned income – by the landlord class in the epoch of Adam Smith and David Ricardo, and by the financial class and monopolists later in the 19th century. The task of the “left” was to tax away such rents, or to take natural monopolies into the public domain by socializing them.

The political leaders of today’s “left” parties have been selected, financed and given grants and authoritative positions at foundations and other NGOs (Non-Government Organizations) financed by the U.S. National Endowment for Democracy (NED) and other right-wing political forces.

The result is a Professional and Managerial Class (PMC) serving the dynamics of finance capitalism instead of industrial capitalism. Such “New Left” or Third Way parties no longer promote the interests of the wage-earning (and increasingly indebted) economy at large.

(1) Can the US issue and monetize its Debt in order to fund foreign wars?

Foreign wars are fought with a combination of domestic U.S. spending on the military-industrial complex, payments to soldiers and other spending within the United States. This absorbs government spending at the cost of domestic social programs and other non-military purposes. That forces the U.S. budget into deficit. The Treasury could simply print this money, but is more likely to borrow by issuing Treasury bonds and other securities.

The major destabilizing problem of waging foreign wars is their balance-of-payments cost. The U.S. Government cannot print foreign currency, and that is what has to be spent in its nearly 800 foreign military bases. When the Korean War began I 1950, the U.S. balance of payments moved into deficit – and the entire deficit was caused by military spending. (I provide the charts in my book Super Imperialism.)

That spending on foreign supplies for its military bases and fighting, ended up in the hands of foreign central banks. U.S. spending in Vietnam, for instance, ended up being sent to France (as Southeast Asia was part of the French Franc zone). President de Gaulle cashed in these dollars for gold.

By 1971 that forced the United States off gold, as its gold stock was depleted by its foreign military spending. And today, the world has a dollar glut, leading the BRICS and other countries to de-dollarize their economies and break away from U.S. economic control. That has become the cost of U.S. military belligerence.

(2) Is there any limits or constraints to the US Government printing money?

Any government can print money. Weimar Germany and Zimbabwe printed money that caused a hyperinflation.

The problem is to get people to accept this money, and to avoid simply inflating the money supply and hence prices. There is no limit, but the effects represent a constraint. The government ultimately gives value to money by accepting it in payment of taxes and other transactions with the government.

(3) Why is Government debt different to Private debt?

There are a number of differences. Banks create money by lending it into the economy – mainly to customers to buy real estate, stocks or bonds. Governments create money by spending it into the economy as income for recipients (Social Security), and for goods and services, that is, production and consumption.

Banks charge interest on the money that they create. The government money in your pocket is technically a government debt, but it does not charge interest.

Private debt can be wiped out in bankruptcy proceedings. But there are no such procedures for government debt. That is because in principle, governments can always just print the money to pay their bondholders or other creditors. But of course, governments cannot pay debts that are denominated in foreign currency.

That is the problem with the Global South’s debt. Its economies have been so distorted since 1945 by the way that the United States has shaped the international economy in its own interest that countries have no way of earning enough dollars or other “hard currency” by exports to pay the interest and amortization falling due on their foreign debt.

That inability to pay forces them into the hands of the International Monetary Fund, which imposes austerity and other anti-labor policies that keep these debtor countries impoverished and prevent their governments from investing on the basic infrastructure needed to develop their economies to become self-reliant.

(4) Would Universal Basic Income cause a major rise in inflation?

The answer depends on what the recipients do with their income, and whether they are put to work to create a “product” to absorb the income they receive.

It also depends on whether such government subsidy is paid for by progressive income taxation levied on the wealthy – or even more efficiently, on economic rent-seekers in the Finance, Insurance and Real Estate (FIRE) sectors, which do not create a “product” (interest charges and penalties are not a product, nor is the rent that landlords charges – or monopoly rents, for that matter).

So in one sense the economy already has a Basic Income payment – of interest and rents to the financial and other propertied classes that David Graeber calls the One Percent.

Payments of interest and rents to this One Percent does not cause inflation, but just the opposite: It causes deflation, by absorbing more and more income from the economy at large, leaving it unavailable to be spent on goods and services (“product”).

Taxing away such rentier income was the goal of Adam Smith and other classical economists of the 19th century. But the rentiers fought back, and have given special tax preference for their interest and rents, their financial and property income.

If this income were taxed away, there would be no reason to fear inflation from basic income to save the population from homeless, sickness, bad diets and other problems of poverty.

There is another way to provide basic income, of course. That is to provide basic needs as a human right, starting with public medical care, education, housing, and retirement income (pensions) for when they no longer are in the labor force.

At present, these functions have been privatized, forcing individuals to pay for them – and the costs are so heavy that most individuals have been driven into debt (credit-card debt and other forms of debt) simply in order to survive. If the U.S. government provided universal health care, it would not be necessary to give individuals the income to pay for them. These services would be freely available.

Housing is the main problem that has not been addressed. This should be provided on a decent basis instead of “homelessness shelters.”

(5) Would anything change if the world economy stopped being pegged to the Dollar – and becomes pegged to another currency like the Yuan?

There is no currency that could replace the dollar, and none that SHOULD replace it. The problem is having ANY country’s currency the world’s monetary base.

The United States has spent dollars into the world economy primarily by its military spending, and also by its takeover of foreign resources. This is not a fair or good way of providing a monetary base.

What this discussion really is about concerns inter-government relations – debts and financial claims. These are best met by an artificial means of inter-government settlement from payments imbalances. Keynes proposed such a settlement system in his 1944 bancor. U.S. diplomats rejected this, wanting to use the dollar as a means of controlling other countries – and hurting or destabilizing them by denying them access to spending in dollars (the SWIFT system of bank clearing), or currency raids on countries not following U.S. policy.

No other country in the world has sought such unipolar hegemony, and none are likely to do so.

(6) Keir Starmer wants to cut the benefits for the poor. Would such cuts be bad for businesses in the UK and for the British economy as a whole?

Instability always is bad. Homelessness, personal bankruptcy and falling living standards are signs of economic shrinkage leading to collapse and a failed state. Crime rates rise and society becomes less livable.

(7) Before he was assassinated, Julius Caesar was planning on forgiving the debts of people, could you please elaborate on that?

My book The Collapse of Antiquity describes Caesar’s policy. He had been a supporter of Catiline, who sought to lead a revolution of debtors advocating debt cancellation. But upon taking power, Caesar’s bankruptcy act benefited mainly the wealthiest Romans, the land owners. At the time he was assassinated, he was trying to maneuver a check on the extreme pro-creditor rules that the Roman oligarchy imposed.

Subsequent Roman Emperors (Trajan, etc.) cancelled debts in the form of tax arrears. But most such arrears were owned by the oligarchy of landowners. So again, most debt cancellations are for the well-to-do property owners, not the less affluent debtors.

(8) When we talk about Debt cancellation, is this a one-off or doing away with the concept of Debt?

Every economy operates on credit, and credit is debt. So there is no way of avoiding the “concept of debt.” The problems lie with the terms of payment when people are unable to pay their debts falling due.

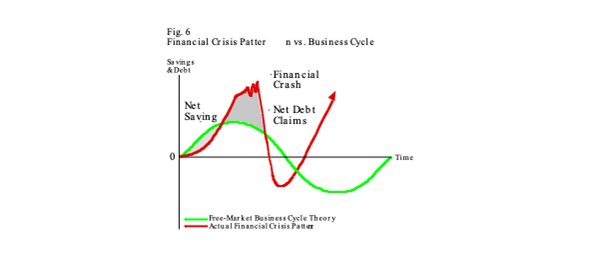

The problem is that debt – especially interest-bearing debt – tends to grow faster than the economy at large. This means a rising debt overhead. That is a chronic problem throughout all history. Debts grow exponentially. Any rate of interest is a doubling time. But economies grow in an S-curve, tapering off – largely because of debt strains.

If debts are not cancelled, then there is a rising transfer of income and property to creditors. The economy polarizes. To avoid this, debts need to be cancelled when they become so top-heavy that the economy is subjected to monetary and financial austerity.

(9) Does Government need to borrow money from the wealthy and from Private banks in order to fund spending on programs such as building social housing for the poor?

Governments don’t need to borrow. In the U.S. Civil War, the North printed greenbacks to provide the means of payment to support the economy that was fighting the South. In World War I, many economists forecast that the European countries could only keep fighting for half a year or so, and then would run out of money. But they all printed it, suspending gold convertibility that limited peacetime spending.

But what governments have done in times of war can be done in times of peace as well. So governments do not have to borrow from wealthy individuals (mainly the One Percent) or banks. And the effects of printing money are no more inflationary than borrowing money. That is because the money that the One Percent spend on buying Treasury bonds would not otherwise be spent on buying consumer goods. The bondholders already are consuming everything that they want. So the government would simply be printing and spending money into the economy in any case, whether they print their own money or borrow it.

(10) Overall has growth in the economy in places like the USA and the UK being higher since the Neo-Liberal period of Reagan and Thatcher or was economic growth higher when the USA and the UK before all the Privatisations, reforms and so on of Reagan and Thatcher?

The real question here is what kind of growth you’re talking about.

Growth was much better prior to the 1980s when it took the form of Industrial Capitalism. The policies of Thatcher and Reagan shifted the economy into Finance Capitalism. This is what has led to de-industrialization of the British, U.S. and other neoliberalized economies. In that sense, we are in an epoch of de-growth and financialized austerity.

Economies are turning into a vast Thames Water crisis of privatization and financialization, loading down industry and personal budgets with debt service that adds to the cost of production and the cost of living.

A new form of exploitation is added to that of employers hiring wage labor to produce products to be sold at a markup. Employees are driven into debt to pay for the soaring cost of services produced by government infrastructure that has been privatized and bought with debt-leveraging that builds rising interest and absentee management charges into the cost of water, transportation, communications, health care, education and other services being provided.

What has been “growing” is debt, and also economic polarization between a creditor layer at the top and a deepening layer of debt-burdened industry and consumers (wage earners) below them. Financial wealth has been growing without a corresponding increase in real “product” (the “product” of Gross Domestic Product, GDP).

Thatcher turned housing away from a function of living to an investment vehicle, and absentee landlordship increased. The same has happened in the United States since the 1980s.

Privatization does not create a “product.” It turns housing and natural infrastructure monopolies into rent-extracting vehicles for land rent, monopoly rent, and financial rent (interest). This is extractive, not productive.

(11) Why has austerity failed to lead to a boom in the economy, what did Government do wrong that has meant that austerity failed to create the economic benefits that the politicians promised?

What is “the economy”? For the One Percent, it is their wealth in the form of bonds, stocks and real estate ownership (mainly absentee ownership of housing and commercial real estate). That is the post-industrial economy of finance capitalism.

For the 99 Percent it is consumption and production – the economy that classical economists analyzed as Industrial Capitalism.

The boom has been concentrated in the financial markets and real estate, not in industry and the economy at large.

A debt overhead and the related financial austerity never creates benefits for the economy at large – but it does squeeze out interest and rents for the One Percent.

Credit is needed to support investment in the means of production and public infrastructure. But that need not meet paying interest and debt overhead to an oligarchy of the One Percent.

What has been lost from the political discussion is the concept of rent (land rent, monopoly rent and interest) as unearned income, not as a “product.” Yet a rising proportion of what is considered to be GDP is not “product” but merely a transfer payment from the economy at large to the FIRE sector and kindred rent extractors.